montana sales tax rate 2021

775 for vehicle over 50000. Instead of the rates shown for the Helena tax region above the following tax rates apply.

Montana State Taxes Tax Types In Montana Income Property Corporate

Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return.

. There is 0 additional tax districts that applies to some areas geographically within Helena. The December 2020 total local sales tax rate was also 0000. The Helena Sales Tax is collected by the merchant on all.

The Montana sales tax rate is currently. Download all Montana sales tax rates by zip code. As of January 1 2021.

Vehicle owners to register their cars in Montana. 2021 State. The minimum combined 2022 sales tax rate for Billings Montana is 0.

The Helena sales tax rate is NA. We encourage all Montanans to file early and electronically. This is the total of state and county sales tax rates.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. The Billings sales tax rate is 0. Wayfair Inc affect Montana.

Did South Dakota v. Imposition of Tax Imposition And Rate Of Sales Tax And Use Tax -- Exceptions 15-68-102. Did South Dakota v.

The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible. The Blaine County sales tax rate is. Tax rates last updated in April 2022.

Detailed Montana state income tax rates and brackets are available on this page. The median property tax in Montana is 146500 per year for a home worth the median value of 17630000. 0183 per gallon.

Sunday January 01 2017. The Helena Montana sales tax is NA the same as the Montana state sales tax. The state sales tax rate in Montana is 0000.

7 rows The Montana State Tax Tables for 2021 displayed on this page are provided in support of the. 2022 Montana Sales Tax Table. Federal excise tax rates on various motor fuel products are as follows.

Imposition and rate of sales tax and use tax -- exceptions. Counties in Montana collect an average of 083 of a propertys assesed fair market value as property tax per year. While many other states allow counties and other localities to collect a local option sales tax Montana does not permit local sales taxes to be collected.

Montana Individual Income Tax Resources. The minimum combined 2022 sales tax rate for Sheridan Montana is. Montana is ranked number twenty nine out of the fifty states in order of the average amount of property taxes collected.

The state sales tax rate in Montana is 0 but you can customize this table as needed. State State Sales Tax. Montana Code Annotated 2021.

The Montana sales tax rate is currently 0. SALES TAX Part 1. Montana cars and trucks are exempt from sales tax in Montana MCA 61-3-311 and if you own your pickup van or car through a Montana LLC you can take advantage of permanent registration.

We encourage all Montanans to file early and electronically. The County sales tax rate is 0. This is the total of state county and city sales tax rates.

Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return. The County sales tax rate is. AUGUST 31 2021.

The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible. The Montana state sales tax rate is currently. Montana Department of Revenue.

Liquefied Natural Gas LNG 0243 per gallon. The State of Montana imposes a variety of registration fees on motor vehicles trailers and recreational. Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return.

The December 2020 total local sales tax rate was also 0000. The 2018 United States Supreme Court decision in South Dakota v. Montana has no state sales tax and allows local governments to collect a.

The current total local sales tax rate in Big Timber MT is 0000. The Sheridan sales tax rate is. Montana Individual Income Tax Resources.

The Montana income tax has seven tax brackets with a maximum marginal income tax of 690 as of 2022. Montana Individual Income Tax Resources. The minimum combined 2022 sales tax rate for Blaine County Montana is.

The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible. Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here as opposed to. Sales tax region name.

1 A sales tax of the following percentages is imposed on sales of the following property or services. Although the lowest rate rises to 47 percent up from 10 percent conforming to the federal standard deduction 12400 last year compared to Montanas current standard deduction of 4790 yields tax savings for low-income taxpayers as well. This is the total of state county and city sales tax rates.

7 rows In Montana theres a tax rate of 1 on the first 0 to 3100 of income for single or married.

Montana State Taxes Tax Types In Montana Income Property Corporate

How To Charge Sales Tax And Shipping For Your Online Store Hostgator

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

U S States With No Sales Tax Taxjar

Sales Taxes In The United States Wikiwand

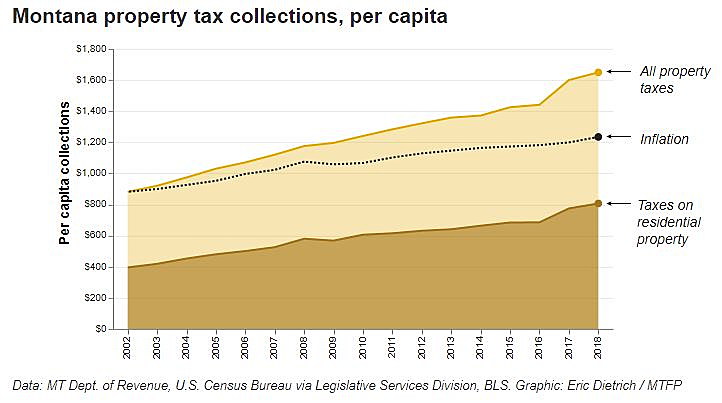

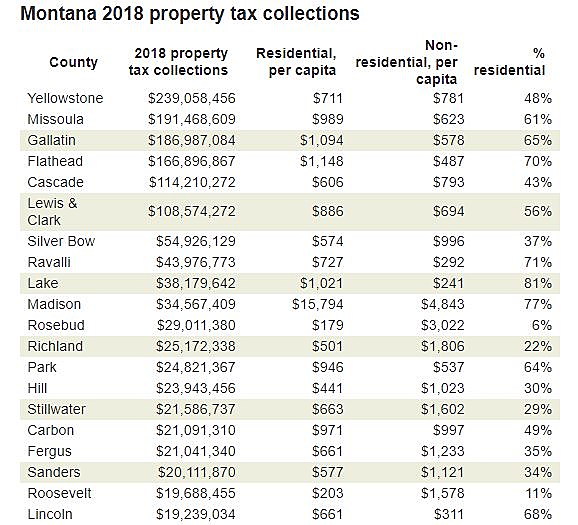

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana State Taxes Tax Types In Montana Income Property Corporate

Updated State And Local Option Sales Tax Tax Foundation

Historical Montana Tax Policy Information Ballotpedia

States With Highest And Lowest Sales Tax Rates

Montana Sales Tax Rates By City County 2022

Tax Rates To Celebrate Gulfshore Business

Montana Income Tax Information What You Need To Know On Mt Taxes

Ranking State And Local Sales Taxes Tax Foundation

Sales Tax On Saas A Checklist State By State Guide For Startups

How Do State And Local Sales Taxes Work Tax Policy Center

Monday Map State And Local Sales Tax Collections Tax Foundation