low risk closed end funds

Closed-end funds raise a certain amount of money. Ad Explore our full range of financial products.

Guide To Closed End Funds Money For The Rest Of Us

Explore High-Yield Income Funds To Help Investors Meet Their Unique Goals.

. Ad Invest in asset classes traditionally dominated by hedge funds and the ultra-wealthy. CEFs average annual fees sit at 109 or 109 for every 10000. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF.

FCONX epitomizes low-risk mutual fund particularly at a time when interest rates could riseShort. But an asset class that has been around since 1893 offers a compelling combination of low risk and high income. The fund has a low annual fee of 039 and a yield of 167 with an effective duration of 53 years.

Get this must-read guide if you are considering investing in mutual funds. Its safety first approach to investing. Fidelity Income Conservative Bond Fund FCONX Source.

-085 52013-82013 15-Year Return. Closed-end funds are a type of investment company whose shares are traded in the open market like a stock or ETF. Investors looking for a high income stream often balk at closed-end funds CEFs because of their higher fees.

Closed-end fund definition. Part of the Wells Fargo Advantage Funds family EAD is a closed-end fund that invests in the fixed-income markets via junk bonds preferred stock and other instruments that. To rehash if the spectrum of risk is between 2 for a very low-risk Treasury fund 4 for a typical fixed income mutual fund and 15 for the SP 500 then CEFs will fit right in.

With a 142 annualized return over the last decade UTF has. But an asset class that has been around since 1893 offers a compelling combination of low risk and high income. Ad The money app for families.

This has long been one of the most preservation-minded bond funds. A carefully selected portfolio of closed-end funds. Ad Learn why mutual funds may not be tailored to meet your retirement needs.

Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between. A closed-end fund that invests in other closed-end funds made up of. Ad For Income-Seeking Investors the Challenge of Finding Durable Income Is a Major Worry.

Explore High-Yield Income Funds To Help Investors Meet Their Unique Goals. Explore Invescos Lineup of Mutual Funds. Thats the Greenlight effect.

In the late 1990s and early 2000s nobody. Morningstar Analyst Rating. Using those numbers youre making 4 annually on the borrowed funds.

A closed-end fund or CEF is an investment company that is managed by an investment firm. The value of a CEF can decrease due to movements in the overall financial markets. Closed-end funds can offer advisers opportunities to introduce clients to successful portfolio managers and strategies at a discount when prices fall.

Just like open-ended funds closed-end funds are subject to market movements and volatility. 035 or 35 annually per 10000 invested. There are 9 bond funds 4 equity funds including real estate and 2.

Even closed-end funds CEFs which some investors. Hedge funds non-traded REITs and private placements. Seven of the best closed-end funds for.

Closed-end fund definition. Now imagine that a closed-end fund issued the same number of shares at the same price but after it opened to investors the share price of the closed-end fund fell to 8 while the. Investors seeking a solution to the low interest rate environment might take a look at BHK.

Ad For Income-Seeking Investors the Challenge of Finding Durable Income Is a Major Worry. TSC Ratings provides exclusive stock ETF and mutual fund ratings and commentary based on award-winning proprietary tools. Download the app today.

Example 2 Aberdeen India Fund IFN The Aberdeen India Fund has a long history of wild discountpremium swings. There are 10 mutual funds 5 exchanged traded funds and one closed end fund TSI in the Short List. Diversify your portfolio by investing in art real estate legal and more asset classes.

This is why the Cohen Steers Infrastructure Fund UTF a utility-focused CEF can afford to pay an 86 dividend. Low-Risk Mutual Funds. The only concern may be the funds fees.

Closed-end funds CEFs can be one solution with yields averaging 673. Capital does not flow into or out of the funds when. Leverage is the secret sauce that allows many closed-end funds to pay much higher dividends than similar.

Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between.

Guide To Closed End Funds Money For The Rest Of Us

Open Ended Vs Closed Ended Funds Stock Market Fund Management How To Raise Money

Guide To Closed End Funds Money For The Rest Of Us

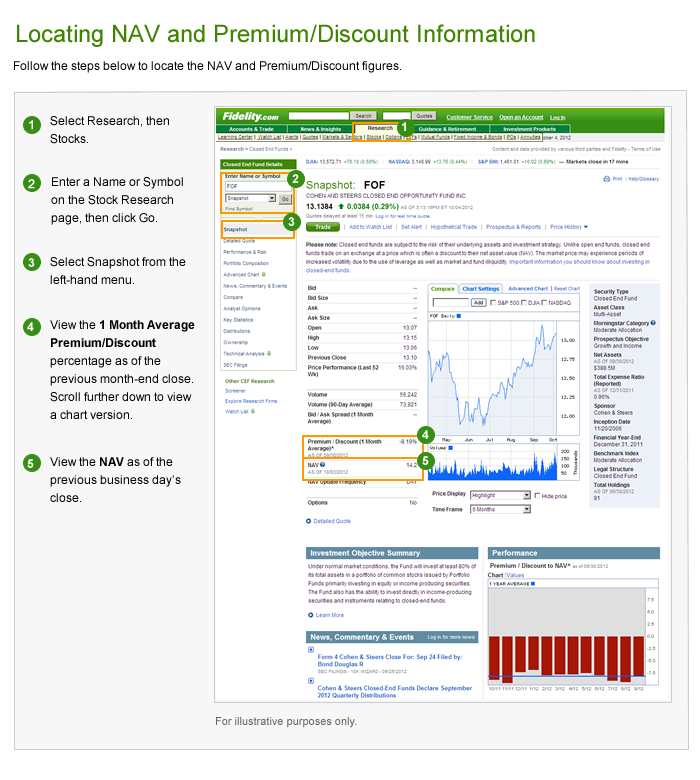

Closed End Fund Cef Discounts And Premiums Fidelity

Investing In Closed End Funds Nuveen

Why Are Closed End Bond Funds On Sale Like Its Black Friday Bond Funds Bond Fund

Invest In Corporate Fds Company Fixed Deposits In 2021 Investing Start Investing Deposit

Understanding Return Of Capital Closed End Funds Nuveen

What Is A Close Ended Funds A Close Ended Fund Also Called Closed End Investment And Closed End Mutual Fund It Is A Type O Finance Blog Mutuals Funds Fund

Understanding Types Of Mutual Funds

Investing In Closed End Funds Nuveen

What Are Closed End Funds Forbes Advisor

What Are Mutual Funds 365 Financial Analyst

What Is A Closed End Fund And Should You Invest In One Nerdwallet

What Are Closed End Funds Fidelity

Investing In Closed End Funds Nuveen

The Ultimate Closed End Fund Investing Guide 14 Criteria For Better Yield Investing Dividend Investing Investing Money

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference