tax per mile reddit

A tax per mile. Posted by 7 years ago.

Platform Advertising Citap Digital Politics

A vehicle mileage tax or vehicle miles traveled fee would charge.

. My wife started a new job and received a 10000 starting bonus. Aug 8 2021. A driving tax proposed by President Joe Biden would cost Americans 8 cents per mile.

The standard mileage rates for the use of a car also vans pickups or panel trucks are. I imagine if this is ever implemented even though we dont get to write off the miles we drive as employees for the 060mile that businesses can write off Id think thered be mileage tax writeoffs for miles we report as being used to drive tofrom work or driving for work. A vehicle mileage tax or vehicle miles traveled fee would charge motorists a fee based on how many miles they drive.

If your car gets 24 mpg now youd be paying 120 in tax based on mileage vs the 060 if paying per gallon. The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021. Due to not fulfilling her contract she had to pay back the full 10k to the company even though she didnt actually receive that much.

From a fairness perspective both passenger and commercial vehicles would pay the vehicle miles tax. The timing of a vote on a 12 trillion infrastructure package divided House Democrats this week. Log In Sign Up.

Run it just often enough to add a few miles per inspectin period then swap outfor the real one for the next while. Standard Mileage Rate for Business. Those miles could be racked up from meetings with clients travel to secondary work sites or errands.

Yuo could end up driving a hundred K per year but only showing maybe ten. And 10000 in expenses reduces taxes by 2730. Thats 12 for income tax and 1530 in self-employment tax.

Suppporters say that the advantages of a vehicle miles driven fee include. We do pay per mile. For 2021 tax filings the self-employed can claim a 56-cent deduction per business mile driven.

Deductible business miles include driving to work-related functions meeting clients and going to job sites. The estimated cost per mile of gas is 184 cents down 40 from 298 cents per mile in 1993 all amounts in. Not implementing it is punitive to urban areas that have to pay tens of thousands per mile of road per year in maintenance costs for a couple people who want to live in the middle of nowhere.

In some cases the new per mile tax may end up being in. In 2019 Oregon lawmakers expanded their VMT program and prohibited cars that get fewer than 20 miles per gallon from participating in the program moving forward. Due to taxes she only received about 6800 of that money.

More efficient cars end up being nailed worse. However electrics dont pay this taxfee and drive as many miles as they like on our roads for free. 206 of the 611 vehicles in Oregon.

I seen few people on my social media share an article from the Daily mail about this. The time period can vary but is typically a vehicle miles travel fee is measured in a one year period. For a pay-per-mile tax to generate that kind of revenue drivers would need to pay an average of 22 cents per mile.

Search all of Reddit. 005 per mile would end up as a massive increase in the taxes you are paying. Its called a fuel tax on every gallon of gas or diesel.

I wont link the daily mail article but. This includes 10 million each year from 2022 to 2026. Keep a spare speedo-odo handy.

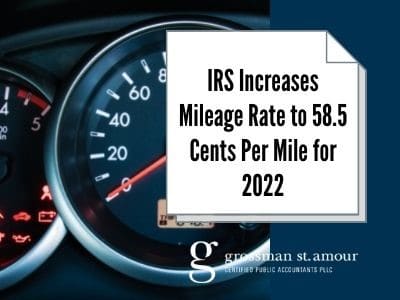

With the rise of electric vehicles cars with better miles per gallon and decreased personal travel during the COVID-19 pandemic revenue from the gas tax has declined. Insert terrible YMMV joke. 1 day agoFor the second half of 2022 the standard mileage rate for business use of an automobile will increase from 585 to 625 per mile.

If you drove 10000 miles exactly then you could take a tax deduction of 5450. A vehicle miles driven fee could help raise revenue for essential transportation and infrastructure projects. Drive something like an old Benz 123 or 126.

This means that 545 cents or 0545 must be multiplied by the number of business miles driven to determine the amount that you deduct from the money that you earned. My solution is not to find a way to tax them AND fuel vehicles by the mile plus gas tax. If you drive your car for your deliveries every mile is worth 56 cents off your taxable income the standard mileage rate for the 2021 tax year it bumps up to 585 per mile in 2022.

The infrastructure bill includes 125 million to fund pilot programs to test a national vehicle miles traveled fee. However after a couple months she decided to go a different direction and left that job. 43 votes 194 comments.

When you take it in for the annual look inside the orses mouth. Simply put if you drive a vehicle you would pay money to the government for every mile you drive. Congress has refused to raise the Federal Fuel Tax since 1993 1.

The state gasoline tax is only 019 thats only represents 4-6 of the cost of a gallon of gasoline. For example if you drove your vehicle 1000 miles for IRS-approved business purposes in 2021 multiply 1000 miles x 056 per mile. American drivers could soon trade paying taxes on gas at the pump for owing the government annual per-mile user fees under a new pilot program recently passed by the Senate in Joe Biden s 12.

The additional Per Mile tax discussed in this article is different from the current IFTA agreement where drivers already have to track their movements and submit a quarterly report. The rates for deductible medical travel and moving expenses.

Traffic Why It S Getting Worse What Government Can Do

Paying By The Mile And Ending The Gas Tax

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

How To Conquer Your Driving Anxiety Phobia

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

Traffic Why It S Getting Worse What Government Can Do

Editorial Biden Brings Back Road Usage Tax Plan

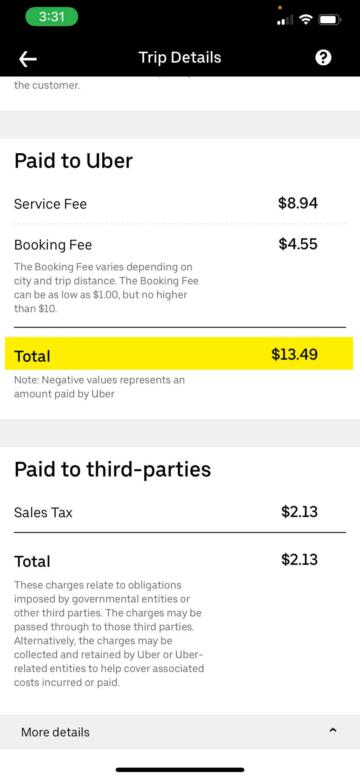

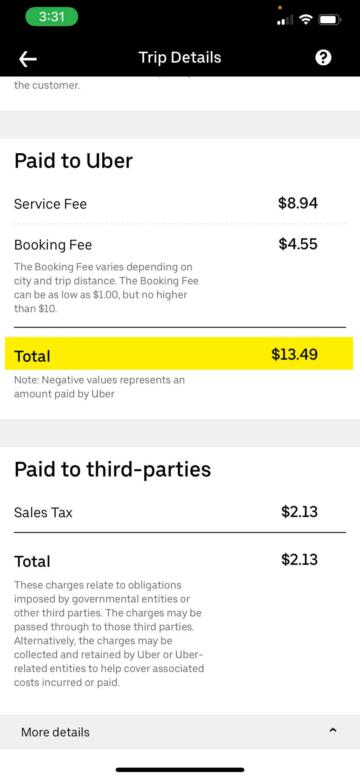

Secretive Algorithm Will Now Determine Uber Driver Pay In Many Cities The Markup

How To End The American Dependence On Driving Vox

The Absolute Best Doordash Tips From Reddit Everlance

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc

Infrastructure Bill Includes Per Mile Road Tax Test That Will Track Drivers Travel R Futurology

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc

The Absolute Best Doordash Tips From Reddit Everlance

How My Dad Got Scammed For 3 000 Worth Of Gift Cards The Hustle

How Can I Reduce My Taxable Income At The End Of The Year

Infrastructure Bill Includes Per Mile Road Tax Test That Will Track Drivers Travel R Futurology

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek